This article is written in partnership with jesmondmizzi.com.

This article is written in partnership with jesmondmizzi.com.

With all this talk about private pension plans and the importance of saving up for our retirement in Malta, we thought it was time to get practical about it all.

Together with Joanna and the team at Jesmond Mizzi, we’ve put together a simple way for you to actively work on your savings.

Your Free Savings Printable

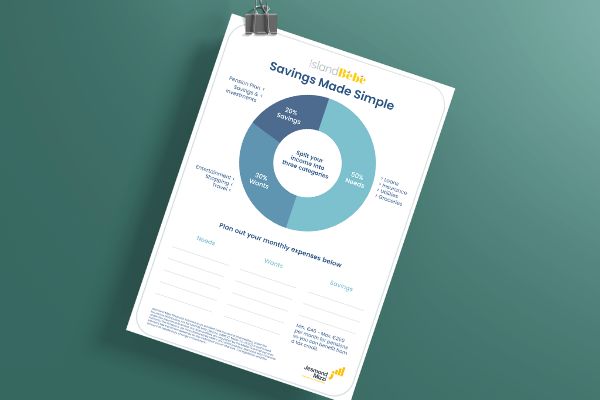

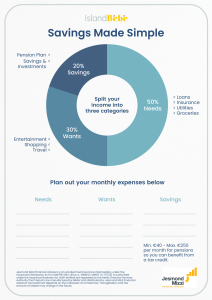

This Printable Worksheet is something you can work on alone or with your partner to plan out your monthly expenses. The concept is simple – you split your income into three categories, as follows:

This Printable Worksheet is something you can work on alone or with your partner to plan out your monthly expenses. The concept is simple – you split your income into three categories, as follows:

- 50% of your income goes to your Needs.

These are your loans, insurance and utility bills, as well as your monthly groceries, medicines, fuel and transport costs, and so on. - 30% of your income goes to your Wants.

Because no savings plan will ever work if you don’t account for the fun stuff! That’s what life is all about after all. Under Wants, you can include travel, entertainment, eating out, shopping and your hobby-related expenses. - 20% of your income goes to your Savings.

This is where you start taking control of your future. By picking out an affordable and sustainable Pension Plan or Savings & Investment Plan, you can dedicate 20% of your income to a fund that your future self will thank you for.

So how do you use the printable worksheet? Easy:

So how do you use the printable worksheet? Easy:

- Step 1: Actually print it out and set some time aside to fill it out with your partner. This first step is usually the one that most people put off – and then nothing ever happens!

- Step 2: Agree on what should go into each category and jot them down in the columns at the bottom.If you don’t have a plan for your savings column yet, you can read through the articles linked above for more information. You can also get in touch with the experts at Jesmond Mizzi right here! (Remember – when saving between €40 and €250/month for a Pension Plan you can get up to €750 in tax credit!)

- Step 3: Calculate what your percentage split is for each category, and stick to that! So: if you earn €1000/month, check that your Needs are covered by €500/month. Then stick to €300/month for Wants and contribute the remaining €200/month to your savings plans.

If the thought of budgeting or tracking every last cent sounds intimidating to you (like it does to us), this is a simpler, more straightforward way to ensure you’re covered for life in the finance department.

It all starts with Step 1 – so get your free printable here!

Learn more about your insurance, savings and pension options by getting in touch with the experts at Jesmond Mizzi Financial Advisors or call on +356 2343 5715.

Jesmond Mizzi Financial Advisors is an enrolled Tied Insurance Intermediary under the Insurance Distribution Act for MAPFRE MSV Life p.l.c. (MMSV). MMSV (C-15722) is authorised under the Insurance Business Act. Both entities are regulated by the Malta Financial Services Authority.

The Products are manufactured by MMSV and distributed by Jesmond Mizzi Financial Advisors.

Tax treatment depends on the individual circumstances. Tax legislation and the amount of rebate may change in the future.